Kurs

+13,52%

Likviditet

2,94 MSEK

Kalender

| Est. tid* | ||

| 2026-11-03 | 08:00 | Kvartalsrapport 2026-Q3 |

| 2026-07-17 | 08:00 | Kvartalsrapport 2026-Q2 |

| 2026-05-20 | N/A | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2026-05-19 | N/A | Årsstämma |

| 2026-05-05 | 08:00 | Kvartalsrapport 2026-Q1 |

| 2026-02-12 | - | Bokslutskommuniké 2025 |

| 2025-10-31 | - | Kvartalsrapport 2025-Q3 |

| 2025-07-18 | - | Kvartalsrapport 2025-Q2 |

| 2025-05-21 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2025-05-20 | - | Årsstämma |

| 2025-04-29 | - | Kvartalsrapport 2025-Q1 |

| 2025-02-12 | - | Bokslutskommuniké 2024 |

| 2024-11-04 | - | Kvartalsrapport 2024-Q3 |

| 2024-07-19 | - | Kvartalsrapport 2024-Q2 |

| 2024-05-23 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2024-05-22 | - | Årsstämma |

| 2024-05-22 | - | Kvartalsrapport 2024-Q1 |

| 2024-02-28 | - | Bokslutskommuniké 2023 |

| 2023-11-03 | - | Kvartalsrapport 2023-Q3 |

| 2023-07-20 | - | Kvartalsrapport 2023-Q2 |

| 2023-05-19 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2023-05-17 | - | Årsstämma |

| 2023-05-05 | - | Kvartalsrapport 2023-Q1 |

| 2023-02-10 | - | Bokslutskommuniké 2022 |

| 2022-11-03 | - | Kvartalsrapport 2022-Q3 |

| 2022-07-21 | - | Kvartalsrapport 2022-Q2 |

| 2022-05-18 | - | Kvartalsrapport 2022-Q1 |

| 2022-04-29 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2022-02-11 | - | Bokslutskommuniké 2021 |

| 2021-11-10 | - | Kvartalsrapport 2021-Q3 |

| 2021-08-27 | - | Kvartalsrapport 2021-Q2 |

| 2021-05-18 | - | Årsstämma |

| 2021-05-18 | - | Kvartalsrapport 2021-Q1 |

| 2021-05-03 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2021-02-23 | - | Bokslutskommuniké 2020 |

| 2020-11-06 | - | Kvartalsrapport 2020-Q3 |

| 2020-08-27 | - | Kvartalsrapport 2020-Q2 |

| 2020-05-08 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2020-05-07 | - | Årsstämma |

| 2020-05-07 | - | Kvartalsrapport 2020-Q1 |

| 2020-02-06 | - | Bokslutskommuniké 2019 |

| 2019-11-07 | - | Kvartalsrapport 2019-Q3 |

| 2019-07-18 | - | Kvartalsrapport 2019-Q2 |

| 2019-05-16 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2019-05-15 | - | Årsstämma |

| 2019-05-15 | - | Kvartalsrapport 2019-Q1 |

| 2019-02-07 | - | Bokslutskommuniké 2018 |

| 2018-11-08 | - | Kvartalsrapport 2018-Q3 |

| 2018-08-30 | - | Kvartalsrapport 2018-Q2 |

| 2018-05-04 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2018-05-03 | - | Årsstämma |

| 2018-05-03 | - | Kvartalsrapport 2018-Q1 |

| 2018-02-06 | - | Bokslutskommuniké 2017 |

| 2017-11-07 | - | Kvartalsrapport 2017-Q3 |

| 2017-08-30 | - | Kvartalsrapport 2017-Q2 |

| 2017-05-05 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2017-05-04 | - | Årsstämma |

| 2017-05-04 | - | Kvartalsrapport 2017-Q1 |

| 2017-02-03 | - | Bokslutskommuniké 2016 |

| 2016-11-11 | - | Kvartalsrapport 2016-Q3 |

| 2016-08-30 | - | Kvartalsrapport 2016-Q2 |

| 2016-05-06 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2016-05-03 | - | Årsstämma |

| 2016-05-03 | - | Kvartalsrapport 2016-Q1 |

| 2016-04-20 | - | Kvartalsrapport 2016-Q1 |

| 2016-02-11 | - | Extra Bolagsstämma 2016 |

| 2016-02-05 | - | Bokslutskommuniké 2015 |

| 2015-11-12 | - | Kvartalsrapport 2015-Q3 |

| 2015-07-23 | - | Kvartalsrapport 2015-Q2 |

| 2015-05-06 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2015-05-05 | - | Årsstämma |

| 2015-05-05 | - | Kvartalsrapport 2015-Q1 |

| 2015-02-06 | - | Bokslutskommuniké 2014 |

| 2014-11-07 | - | Analytiker möte 2014 |

| 2014-11-07 | - | Kvartalsrapport 2014-Q3 |

| 2014-07-25 | - | Kvartalsrapport 2014-Q2 |

| 2014-05-29 | - | X-dag ordinarie utdelning TRAD 0.25 SEK |

| 2014-05-28 | - | Årsstämma |

| 2014-05-06 | - | Kvartalsrapport 2014-Q1 |

| 2014-02-06 | - | Bokslutskommuniké 2013 |

| 2013-10-30 | - | Analytiker möte 2013 |

| 2013-10-30 | - | Kvartalsrapport 2013-Q3 |

| 2013-09-26 | - | Extra Bolagsstämma 2013 |

| 2013-07-26 | - | Kvartalsrapport 2013-Q2 |

| 2013-05-08 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2013-05-07 | - | Årsstämma |

| 2013-05-03 | - | Kvartalsrapport 2013-Q1 |

| 2013-02-06 | - | Bokslutskommuniké 2012 |

| 2012-10-31 | - | Analytiker möte 2012 |

| 2012-10-31 | - | Kvartalsrapport 2012-Q3 |

| 2012-07-27 | - | Kvartalsrapport 2012-Q2 |

| 2012-05-09 | - | X-dag bonusutdelning TRAD 0.5 |

| 2012-05-09 | - | X-dag ordinarie utdelning TRAD 1.00 SEK |

| 2012-05-08 | - | Årsstämma |

| 2012-05-03 | - | Kvartalsrapport 2012-Q1 |

| 2012-02-07 | - | Bokslutskommuniké 2011 |

| 2011-11-02 | - | Kvartalsrapport 2011-Q3 |

| 2011-10-05 | - | Kapitalmarknadsdag 2011 |

| 2011-08-03 | - | Kvartalsrapport 2011-Q2 |

| 2011-05-06 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2011-05-05 | - | Årsstämma |

| 2011-05-04 | - | Kvartalsrapport 2011-Q1 |

| 2011-02-08 | - | Bokslutskommuniké 2010 |

| 2010-11-03 | - | Kvartalsrapport 2010-Q3 |

| 2010-07-27 | - | Kvartalsrapport 2010-Q2 |

| 2010-05-07 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2010-05-06 | - | Kvartalsrapport 2010-Q1 |

| 2010-02-09 | - | Bokslutskommuniké 2009 |

| 2009-11-03 | - | Kvartalsrapport 2009-Q3 |

| 2009-08-18 | - | Kvartalsrapport 2009-Q2 |

| 2009-05-07 | - | X-dag ordinarie utdelning TRAD 0.00 SEK |

| 2009-05-06 | - | Årsstämma |

| 2009-05-06 | - | Kvartalsrapport 2009-Q1 |

Beskrivning

| Land | Sverige |

|---|---|

| Lista | Small Cap Stockholm |

| Sektor | Informationsteknik |

| Industri | Programvara |

Intresserad av bolagets nyckeltal?

Analysera bolaget i Börsdata!

Vem äger bolaget?

All ägardata du vill ha finns i Holdings!

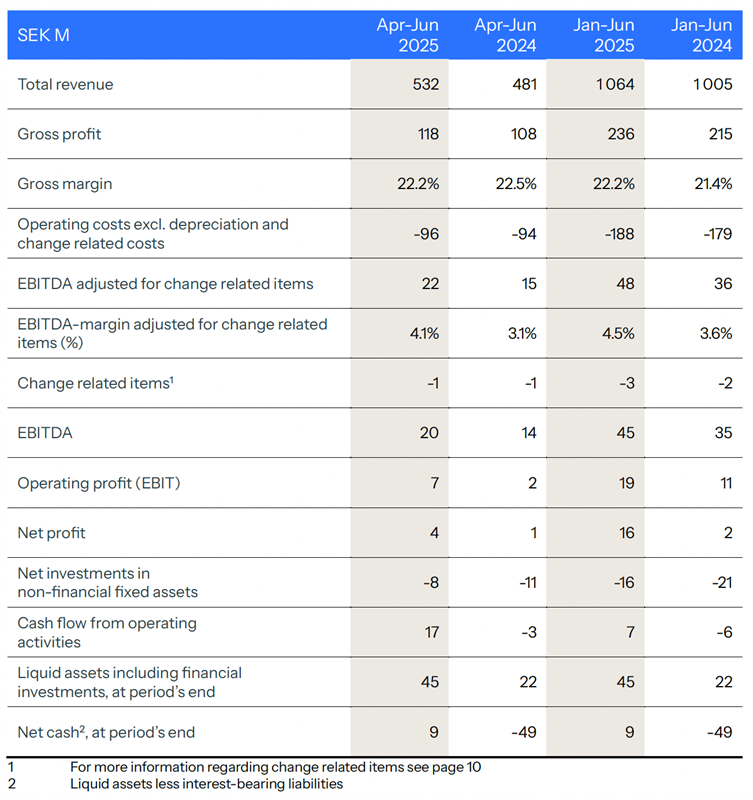

The second quarter, April - June 2025

- Total revenue amounted to SEK 532 M (481), an increase of 11% or 15% adjusted for changes in exchange rates compared to the same period last year.

- Gross profit was SEK 118 M (108), an increase of 9% or 13% adjusted for changes in exchange rates. Gross margin was 22.2% (22.5).

- Operating costs excluding depreciation were SEK 97 M (94), an increase of 3% or 7% adjusted for changes in exchange rates. Operating cost, excluding depreciation and change related items, were SEK 96 M (94).

- EBITDA amounted to SEK 20 M (14). Adjusted for change related items, EBITDA was SEK 22 M (15).

- Investments in immaterial assets, mainly related to product development, were SEK 8 M (10).

- Cash flow from operating activities was SEK 17 M (-3).

- Earnings per share, before and after dilution were SEK 0.06 (0.01).

The interim period January - June 2025

- Total revenue amounted to SEK 1 064 M (1 005), which is an increase compared to the same period last year by 6% or 8% adjusted for changes in exchange rates.

- Gross profit was SEK 236 M (215) an increase of 10% or 12% adjusted for changes in exchange rates. Gross margin excluding change related items was 22.2% (21.4).

- Operating costs excluding depreciation were SEK 191 M (181), an increase of 6% or 7% adjusted for changes in exchange rates. Operating costs, excluding depreciation and change related items, were SEK 188 M (179).

- EBITDA amounted to SEK 45 M (35). Adjusted for change related items, EBITDA was SEK 48 M (36).

- Investments in intangible assets, mainly related to product development, were SEK 16 M (20).

- Cash flow from operating activities was SEK 7 M (-6). 19 MSEK of the Additional Purchase Price paid to Kaha founders in the first quarter of 2025 has been reallocated from investing activities to change in working capital in the cash flow statement.

- Earnings per share, before and after dilution were SEK 0.26 (0.04).

CEO Matthias Stadelmeyer's comments

Tradedoubler delivered a strong operational performance in the second quarter of 2025, with healthy growth in revenue, gross profit and EBITDA. The results reflect our team's consistent execution, the strength of our diversified product portfolio, and the impact of focused strategic investments.

Q2 Results

Total revenue in Q2 increased by 11% to SEK 532 M, or 15% adjusted for currency effects, while gross profit rose by 9%, or 13% adjusted for currency effects, to SEK 118 M. Adjusted EBITDA reached SEK 22 M, up from SEK 15 M in the same period last year. Cash flow from operating activities improved significantly to SEK 17 M and is the fourth quarter in a row with positive operating cashflow, if you disregard the effect from the remeasured additional purchase price to KAHA founders. This demonstrate our focus on generating cash.

The adjusted EBITDA/Gross Profit margin improved to 18% (from 14%), bringing us closer to our long-term target of a 25% margin. As we continue investing in future growth, particularly in Metapic where we aim to become the leading influencer marketing platform in Europe, we are unlikely to hit this target this year already. However, we are on track to achieve it within the next two to three years as planned and previously communicated.

Strong Operational Foundations

Our ability to grow net profit despite adverse FX effects underlines the strength of our operational performance. Gross margin remained stable at 22.2%, and our overall cost base continues to be well managed.

Strategic Progress

Following the launch of our US office in Miami, we are gaining early traction and deepening conversations with brands, agencies, and publishers. Making an impact in United States will still take time, but the feedback confirms our positioning as a network that combines powerful technology with strong local service - a combination in demand in the US market.

Our refreshed brand positioning continues to support broader recognition in key markets. The combination of Partner Marketing, Influencer Marketing and App Marketing under one roof is resonating with clients and partners seeking integrated and performance-based solutions.

Looking Ahead

With a solid first half behind us, we are optimistic about our long-term outlook. Revenue development is on track and our strategic investments will pave the way for sustainable growth. While these investments will weigh on short-term profitability, we are confident that they will drive long-term value for clients and shareholders alike.

Contact information

Matthias Stadelmeyer, President and CEO, telephone +46 8 405 08 00

Viktor Wågström, CFO, telephone +46 8 405 08 00

E-mail: ir@tradedoubler.com

Other information

This information is information that Tradedoubler AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Swedish Securities Markets Act. The information was submitted for publication, through the agency of the contact persons set out above, at 08.00 CET on 18 July 2025. Numerical data in brackets refers to the corresponding periods in 2024 unless otherwise stated. Rounding off differences may arise.